DAL Identity International LLC Profits Interest Grants

Fact Page & Investor Access

DAL Identity International LLC Profits Interest Grants — Fact Page & Investor Access

Legal Disclaimer

This investment is for ACCREDITED INVESTORS ONLY. The criteria for accredited investment is provided under the end section “DISCLAIMER DETAILS”.

The following information meticulously outlines the terms and conditions associated with DAL Identity International LLC’s (DAL) PROFITS INTEREST GRANT Structure. Prospective investors are urged to carefully read and comprehend the following information before considering participation in the Profits Interest Grant Offering.The Certificate that accesses the Profits Interest Grant is NOT A SECURITY, NOR IS IT A CRYPTOCURRENCY. It is strictly an investment into future profits. For more information on securities and cryptocurrencies, please consult with a legal advisor.

- A Certificate investment into perpetual revenue based on real assets with real uses in the real world

- Huge distribution (payout) upside in the world’s largest emerging industry/sector (Reusable

Identities) - Pioneering technology with hardware and software components that are well ahead of the

competition - An opportunity to change socioeconomic paradigms, reduce human trafficking & eradicate

labour abuses with personally owned Identities - Operated by an all-star executive team with a collective 200 years of innovative experience

Profits Interest Grants Overview:

A Profits Interest Grant, also known as a profits interest or profits participation interest, serves as a prominent equity-based incentive frequently granted to individuals within partnerships or limited liability companies (LLCs). This compensation model, prevalent in the business and investment sectors, offers unique features that distinguish it from traditional equity awards.

DAL Identity International LLC Offer:

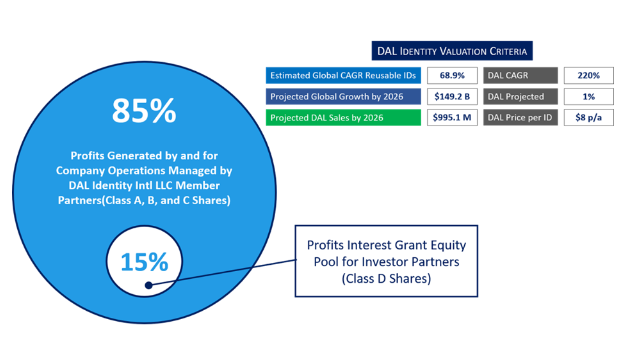

DAL offers an enticing profit-sharing structure both for LLC Member-Partners and Investor Partners, all based on Company performance and a commitment to excellent operations

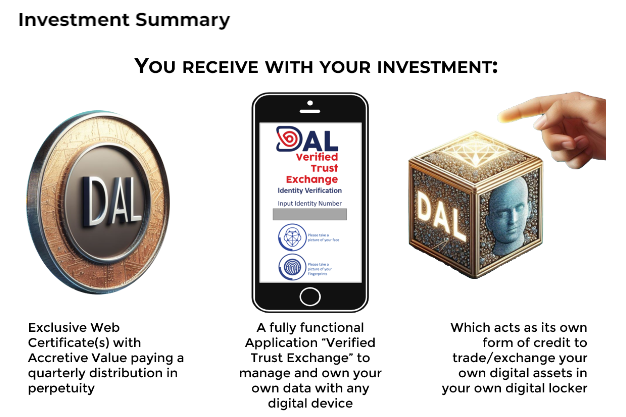

Certificate Details:

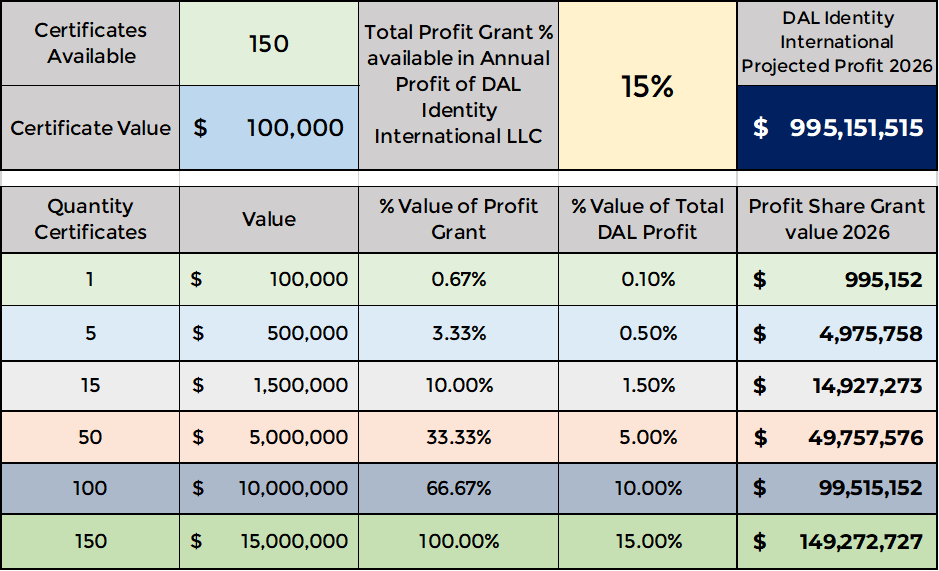

- 150 exclusive Certificates currently valued at USD 100,000 each.

- Represents a tangible and legally-backed investment opportunity.

Distribution:

- Commences in Year 3 (2026) with a projected net profit of USD $995 million.

- Potential return of 9.5 times the initial investment after three (3) fiscal years.

Investment Cap:

- Investors can contribute up to USD $15 million.

- Cap set at 15% of the total revenue pool for balanced participation.

Payout Frequency:

- Quarterly distributions contingent on maintained profit margins.

- Provides a regular and predictable stream of returns.

DAL’s Profit-Sharing Structure:

- Offers a profit-sharing structure for LLC Member-Partners and Investor Partners.

- Based on company performance and commitment to excellent operations.

Investor Eligibility Overview:

- Welcomes participation from accredited investors.

- Emphasizes experience in emerging technology and strategic contributions.

This is what our typical investor looks like and talks like

Certificate Details Clarified:

- Profits Interest Grants are distinct from futures contracts or securities.

- Certificates represent certificates granting access to the revenue pool.

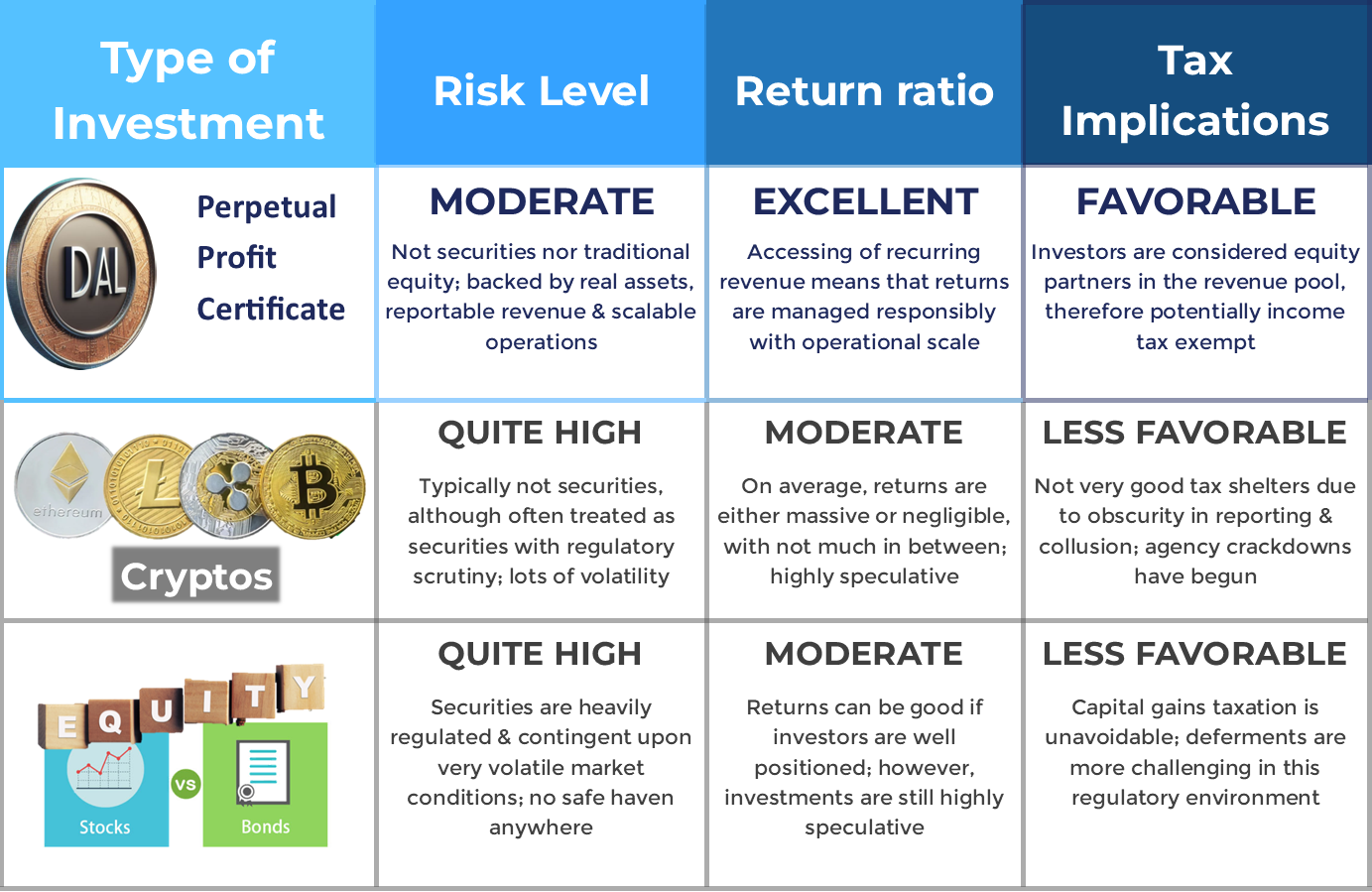

The DAL Perpetual Profit Certificate (a Profits Interest Grant Structure) compares very well against other popular financial investments.

Profits Interest Grant Structure Overview:

– A forward-looking stake in future profits.

– Comprehensive coverage includes income statement profits and market value appreciation.

Key Features of Profits Interest Grants

- Equity Ownership in Revenue:

- Represents an innovative form of ownership.

- Value isn’t tied to the company’s current valuation.

- Distribution of Profits:

- Entitles investors as limited partners to a share of post-grant profits.

- Aligns stakeholder interests with company success.

- Capital Account Treatment:

- Allocations contribute to the investor-partner’s capital account.

- Reflects economic benefits in accounting.

- No Upfront Cost:

- Recipients typically don’t incur fees for investing.

- Value derives from future business success based on current operations.

- Tax Considerations:

- May offer favorable tax treatment.

- Structured for potential capital gains advantages.

- Vesting Period:

- Subject to a vesting period.

- Rewards commitment and contribution.

- Alignment of Interests:

- Designed to align interests with company success.

- Links financial rewards to performance.

Specifics of Profits Interest Grants:

- Entity Variability:

- Terms vary based on legal structure (partnership or LLC).

- Customizable to suit unique entity needs.

- Professional Guidance:

- Legal and tax professionals’ guidance is recommended.

- Ensures compliance and optimization.

Distinguishing Features from Traditional Equity, Cryptos, or Stock Options:

- Non-requirement for option exercise.

- Preservation of company value.

- Focus on real assets and revenue.

- Safeguarding investor, operator, and company interests.

- Contrast with SAFE agreements.

Tax Implications of Profits Interest Grants:

- Non-taxable nature of properly structured grants.

- IRS regulations on vested profits interest.

- Additional conditions for unvested partnerships.

Profits Interest Grant Recipient Status:

- Partnership status requirement.

- Limited partnership dynamics.

- Clear distinction from employee status.

- Taxation considerations.

- Revenue pool participation.

Technology Details — Revolutionizing Asset-Based Tokenization:

- Forensic Identity Management.

- Web 4.0 for secure decentralized data storage.

- Forensic Cryptographic Provenance for transparency and traceability.

- Empowering individuals and facilitating global trade.

DAL Identity — Catalyst for Economic Growth and Financial Inclusivity:

- New era of trust and efficiency.

- Unlocking economic growth.

- Empowering individuals.

- Democratizing access to global asset markets.

Join the Revolution: Secure Your Place in the Future of Asset Certificatization

DISCLAIMER DETAILS

Investor Eligibility:

DAL’s Profits Interest Grant is exclusively offered to accredited investors, defined as individuals possessing $1 million or more in liquid assets. Preference is given to investors with experience in emerging technology investments who can strategically contribute to DAL’s success. Participation is contingent upon the investor’s commitment to excellent operations, and it is limited to serious participants due to the size and scope of DAL’s activities in the global reusable identity market. Investors can purchase Certificates, thereby ensuring a diversified ownership structure within the investor community.

Differences from Traditional Equity, Cryptos, or Stock Options:

- No Exercise Requirement: A Profits Interest Grant does not mandate the holder to exercise an option.

- No Immediate Right to Existing Capital: Unlike shares of stock, there exists no immediate entitlement to a share of the existing capital of the company. In the event of business closure or immediate sale post-grant, the profits interest-holder lacks any claim to the company’s assets. Conversely, in the case of sustained operations and success, the profits-interest holder enjoys a perpetual allocated percentage of revenue.

- Asset-Backed Structure: The Profits Interest Grant Structure is exclusively based on tangible assets and revenue, thereby minimizing speculative elements.

Profits Interest Grant Recipient Status:

A Profits Interest Grant recipient is obligated to become a Limited Partner. In the context of DAL’s Certificate offering, an Investor assumes the role of a Limited Partner without voting rights, personal liability, or unrequested access to inspect Company books and records as a non-voting partner. Limited Partners are invited to attend quarterly meetings for an overview of operations but are precluded from influencing daily activities. Profits interest recipients are to be treated as partners, not employees and are subject to specific tax obligations.

Legal Disclaimer:

- Disclaimer of Liability: DAL Identity International LLC explicitly disclaims any liability arising from reliance on this document. It does not serve as legal or financial advice, and investors are strongly advised to seek professional counsel before participating.

- No Offering of Securities: Certificates do not represent securities or equity ownership. Holding Certificates confers no ownership rights or voting privileges in DAL Identity International LLC.

- Investment Risks: Investors expressly acknowledge the inherent risks associated with investing in DAL Identity International LLC’s Profits Interest Grant. Past performance is not indicative of future results, and there is no guarantee of profits or returns.

- Regulatory Compliance: Investors bear the responsibility for understanding and complying with relevant laws. DAL Identity International LLC disclaims liability for any regulatory breaches by investors.

- No Endorsement or Recommendation: The information provided herein does not constitute a recommendation by DAL Identity International LLC.

- Certificate Transferability: Certificate transferability is contingent upon market conditions, regulatory compliance, and the availability of counterparties.

- Amendment and Modification: DAL Identity International LLC reserves the right to amend these rules, and any changes will be promptly communicated to investors.

- Conclusion and Acknowledgment: By engaging with DAL Identity International LLC’s Profits Interest Grant Certificates, investors explicitly acknowledge and accept the terms outlined in this comprehensive legal disclaimer. Seeking professional advice is strongly advised.

Note: The preceding information forms an integral part of the comprehensive rules and regulations governing DAL Identity International LLC’s Profits Interest Grant Certificates, ensuring adherence to international legal standards and regulatory compliance.